Financial Services

Financial Services Initial Public Offering / IPO

Initial Public Offering / IPO

Show Chart?

Load external content from TradingView!

*You can change or withdraw your consent at any time in the footer under Cookies.

Market Sentiment for eToro Stock (ETOR): Between Hype and Fundamentals

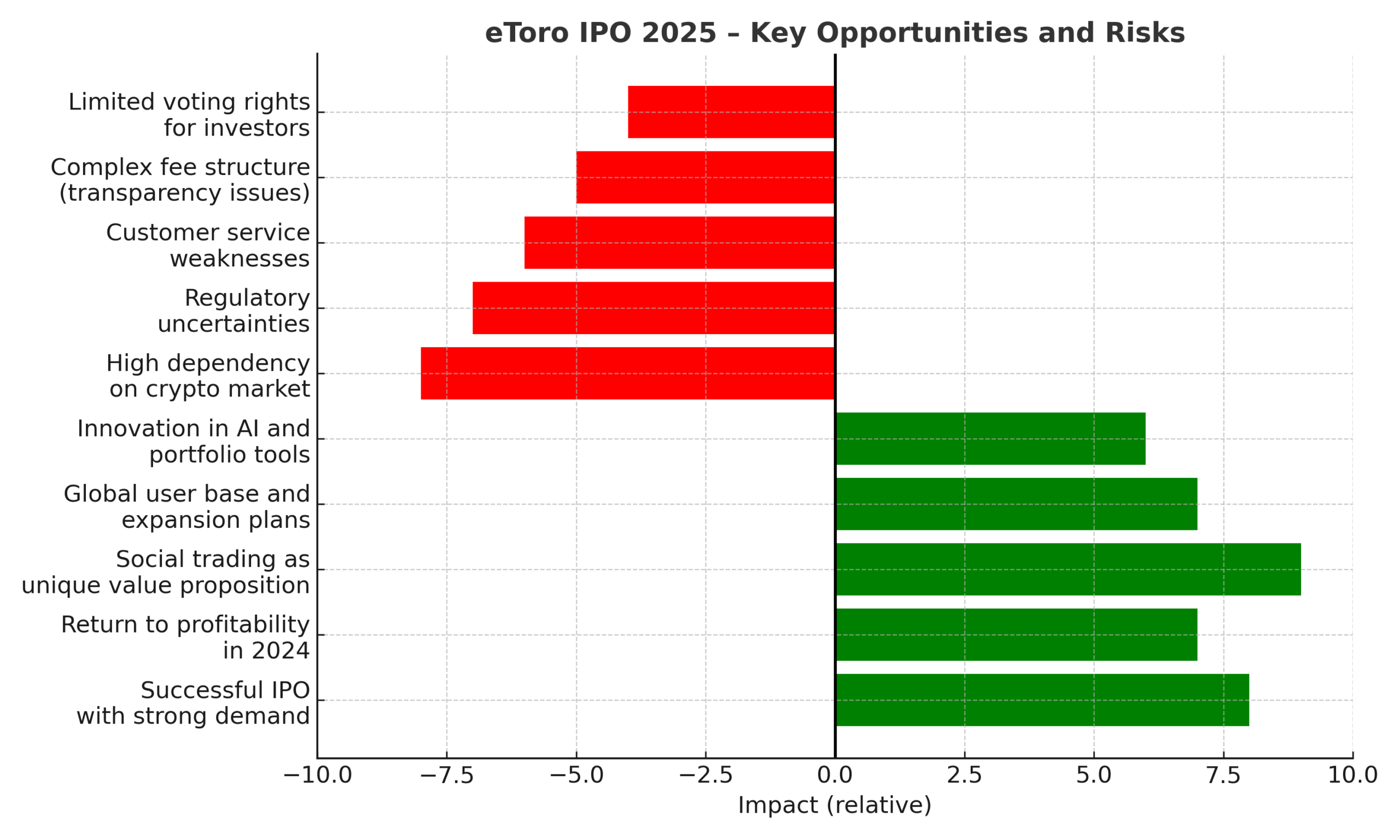

On May 14, 2025, eToro Group Ltd. (NASDAQ: ETOR) made its public debut—and the timing couldn’t have been better. The IPO was significantly oversubscribed, priced above the expected range at $52 per share, and soared nearly 40% on the first day of trading. A stark contrast to its failed SPAC deal in 2022, once valued at over $10 billion. But what does this success reveal about current market sentiment—and how sustainable is it?

IPO as a Signal of Renewed Confidence

The successful IPO indicates renewed confidence among institutional investors. Unlike the inflated SPAC valuation from 2021–22, the ~$4.2 billion IPO valuation was more grounded—supported by a solid return to profitability in 2024, with nearly $192 million in net income and over $800 million in revenue.

The market is clearly shifting: growth-at-any-cost is out, and profitability is back in favor. Some are calling it the start of a new “Fintech Spring.”

Crypto Dependency: Strength or Vulnerability?

While eToro’s turnaround in 2024 was impressive, it was largely fueled by crypto trading—accounting for over 40% of net revenues. That’s both a strength and a vulnerability. If the crypto rally cools off, eToro’s earnings could face significant pressure.

The crypto leverage is real—but so is the risk.

Community-Driven Differentiation

What truly sets eToro apart from brokers like Robinhood or Webull is its social layer: features like CopyTrader™, Smart Portfolios, and a community newsfeed foster a highly interactive user ecosystem. This appeals especially to Gen Z and Millennials.

With 3.58 million funded accounts and 38 million registered users globally, eToro has a solid user foundation. Continuous feature rollouts and AI-powered tools aim to deepen user engagement and retention.

Valuation: Ambitious but Not Excessive

With a P/E ratio of around 22, eToro is priced more conservatively than Robinhood but still well above traditional European brokers like Plus500 or IG Group. That reflects both its upside potential and higher risk profile.

Investors are betting not just on numbers—but on eToro’s ability to convert social trading into a scalable business model.

Looking Ahead: Scaling vs. Skepticism

eToro plans to use its IPO proceeds to fuel global expansion (APAC, MENA, LatAm), introduce new asset classes (options, more equities), and enhance its AI tools and institutional offerings. The ambitions are big.

However, key issues remain: customer service complaints, transparency concerns in fee structures, and limited shareholder rights due to its dual-class share structure could weigh on investor confidence if not addressed.

Conclusion: Cautious Optimism with a Realistic Backbone

eToro’s IPO was a strong comeback—fueled by credible growth, a solid financial turnaround, and a distinctive social trading model. But the enthusiasm is cautious. Investors are watching closely: Can eToro successfully diversify beyond crypto? Will the capital raised drive long-term user and revenue growth? And can the platform deliver operational excellence at scale?

The current sentiment is clearly optimistic—but far from blind. And that may be the most constructive signal of all for fintech's next phase.